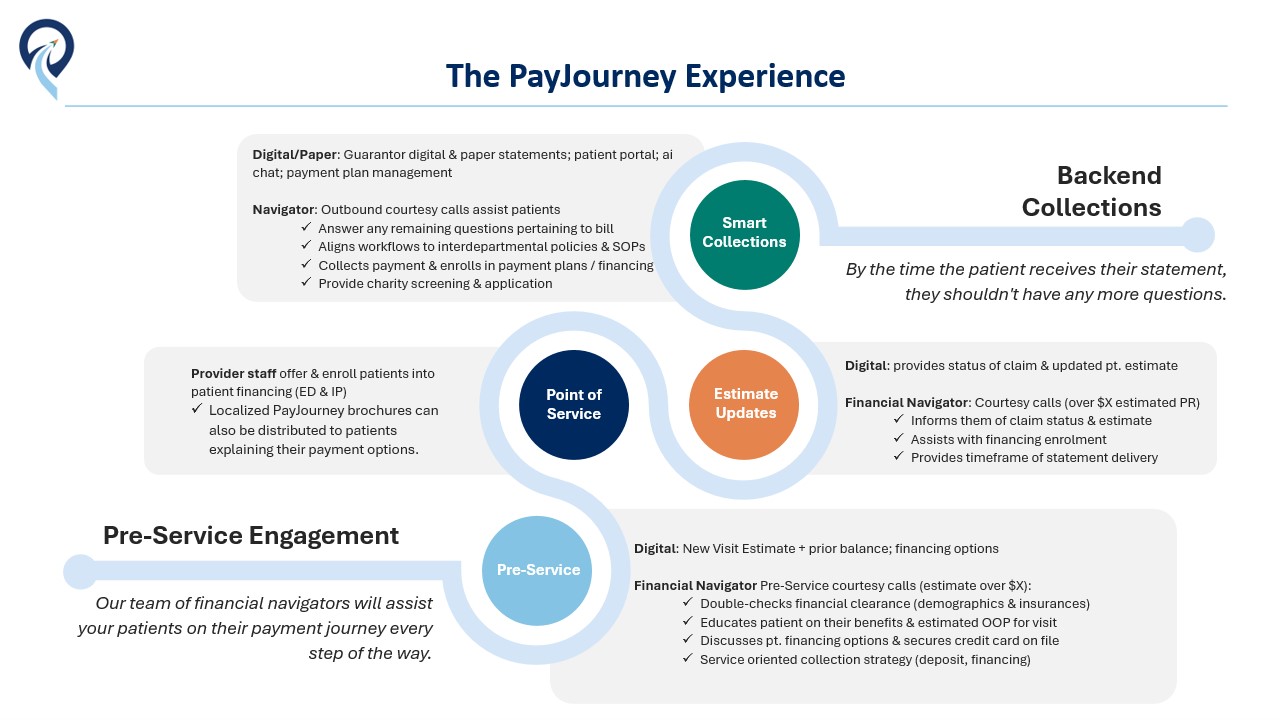

Imagine if by the time the patient received their first statement, they didn’t have any more questions?

Introducing PayJourney, the first comprehensive solution designed to revolutionize both the provider and patient payment experience. PayJourney is dedicated to improving the patient journey while reducing administrative burdens, boosting collections, minimizing bad debt, and cutting overall collection costs for healthcare providers.

With PayJourney, patients receive an end-to-end, concierge-level experience that guides them seamlessly through every step of their payment process—from pre-service through post-service. Our financial navigators infuse with your current patient access workflows to first engage patients before their visit, providing clear education on benefits and visit estimates. This aligns financial expectations and allows current Patient Access teams to focus on other critical financial clearance tasks that impact denials. After their visit, patients receive timely updates on their claim status and any changes to their original estimates, all before the first statement is sent. This innovative approach reduces payment barriers and strengthens the patient-provider relationship, helping the patient feel more ready and willing to pay.

Finally, our financial navigators handle final balance collections when their statement is ready during the Early Out phase, ensuring smooth account resolution. Any remaining financial obligations are seamlessly transitioned to Frost-Arnett’s Bad Debt collection campaigns and beyond.

Leveraging over 130 years of account resolution expertise and infusing optional non-recourse financing & digital engagement, PayJourney enhances provider collections while delivering an unparalleled patient experience.

PayJourney’s Approach

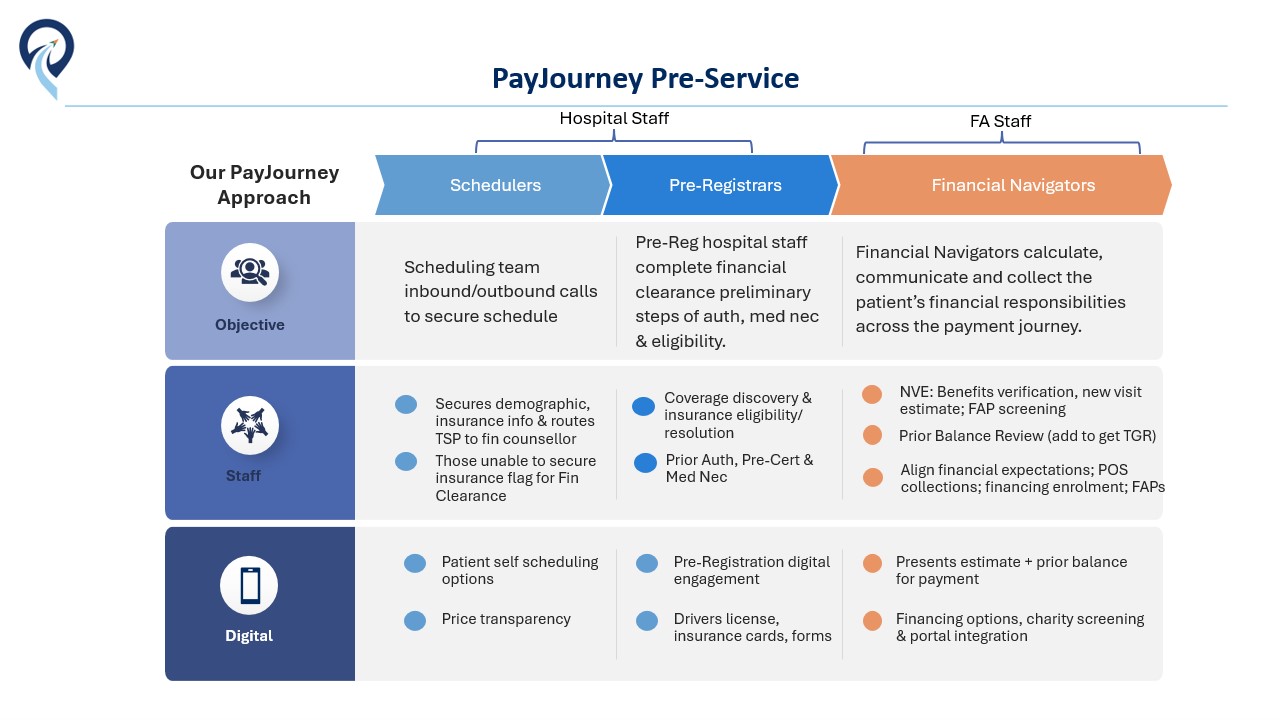

PayJourney is a comprehensive solution that touches many parts of the revenue cycle. That in itself can seem like a daunting task, but our phased implementation leverages the same account information you currently use. PayJourney incorporates change management and implementation specialists to relieve the transition burden from your staff, operationalizing any new workflows with recommended scripting & elbow support. Additionally, all services are designed to stand alone as well and can be added ala carte as needed. How do we do it?

Our team of financial navigators and digital tools engage patients every step of the way. From pre-service to post-service, we provide transparent and accurate estimates, educate patients on their financial responsibilities, and offer a range of payment options, including non-recourse financing, to maximize affordability. Here is how it works:

Pre-Service & Time of Service

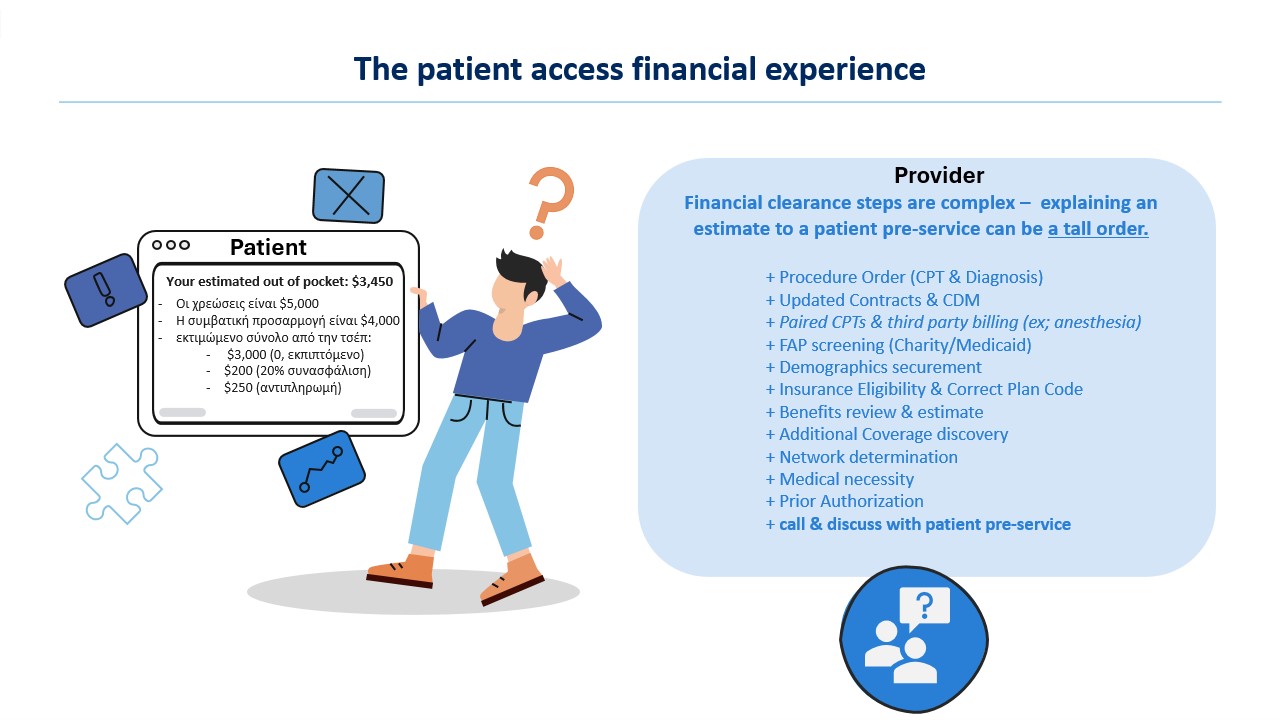

Health system pre-registration teams face multiple challenges, including the difficulty of both educating patients on their financial responsibility and completing necessary tasks like verifying insurance and ensuring financial clearance. PayJourney alleviates this burden by having our financial navigators communicate directly with the patient, delivering the estimate and explaining available payment options. This allows hospital staff to focus on essential financial clearance tasks such as insurance eligibility and prior authorization. Our navigators match the patient’s ability to pay with the appropriate payment strategy, ensuring both collection success and patient satisfaction. This can be accomplished in a couple of different ways including moving all of your pre-registration activities to PayJourney.

Pre-Statement Estimate Updates

Estimates provided to patients are subject to change for a variety of reasons. The problem is the patient is not typically notified when these changes occur in real time, only to receive a bill that differs from their previously communicated estimate without understanding the reasons why. PayJourney’s pre-statement campaigns close this gap by proactively notifying patients (via digital and phone outreach) of any changes to their out-of-pocket estimate. This removes barriers to payment, builds trust and transparency, and prepares patients for the bill when it arrives, thereby increasing the likelihood of prompt payment.

Early-Out Collection (0-120 Days)

By aligning patients with realistic expectations early in their care journey, PayJourney ensures they are more prepared and willing to pay when their statement arrives. Our early-out program involves proactive digital first engagement and traditional phone and statement outreach to guide patients through their financial obligations. Since no two accounts are alike, our Business Intelligence group uses advanced technologies such as machine learning and AI to determine the best workflow to perform outreach to the patients. We collect payments empathetically, educate patients on their benefits, and manage all payment plans and financing options to reduce bad debt. Our collection team’s focus is on patient experience and empathy, improving both collection rates and patient satisfaction.

Proven Results

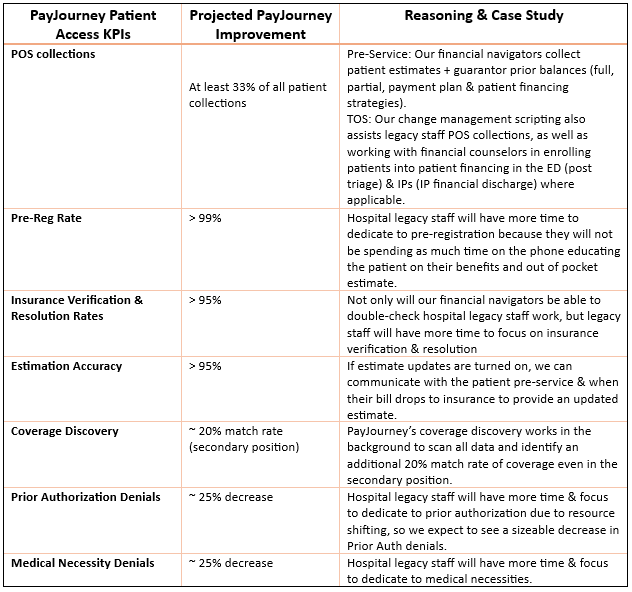

In a recent implementation, PayJourney increased patient cash collections by $1 million (25%) within the first six months, significantly improving satisfaction and engagement. With PayJourney’s comprehensive approach, healthcare systems see the following improvements:

- Pre-Service Collections: Our financial navigators strive to collect at least 33% of all patient collections upfront.

- Estimation Accuracy: By offering estimates at pre-service and post-service estimate updates, we improve the estimated balances that are communicated to patients by over 95%.

- Early-Out Collection Rate: Hospitals should expect to see at least 25-50% increase in overall patient collections by improving the experience and communication during the early stages of the payment cycle.

- Bad Debt Reduction: With better engagement and financing options, we help hospitals significantly reduce bad debt, often by 25-50% or more.

- FTE Reallocation: PayJourney assists healthcare organizations with any reallocated resources during the implementation, working with Sr. Leadership & HR to create recommendations & Job Descriptions

Read our case study HERE

Bad Debt Recovery (121 Days +)

Taking full advantage of Frost-Arnett’s 132+ years of bad debt account resolution, PayJourney provides higher than average recoveries while providing world class customer service to our client partners and their patients. Business intelligence with over 200 publicly available

indicators, coupled with historic guarantor data determines which of 96 different workflows have the highest probability of successful recovery.

PayJourney MONITOR™

PayJourney also addresses long-term bad debt recovery with our MONITOR program. Many healthcare systems write off millions in uncollected debt after it is returned from their primary and/or secondary bad debt vendors – but patient circumstances change over time. Our 4-year lookback and extended monitoring campaigns identify patients whose financial situations have improved, recovering bad debt over time that would otherwise be written off.

This initiative helps hospitals recover an additional 4-6% of bad debt, is Medicare Cost Reporting compliant, and contributes to a 20% increase in overall bad debt recoupment. A much more lucrative & controlled strategy than the selling of bad debt.

Change Management

Adopting PayJourney requires effective change management. Beyond our implementation team, our consulting services help healthcare systems optimize their workflows, realign staffing, and implement new procedures that make the transition seamless. From pre-service financial counseling to post-service collections, we align staff to new strategies, improving efficiency and reducing administrative burden. We also help with communication campaigns, ensuring patients understand the new digital-first approach to billing.

Implementation

PayJourney’s phased implementation starts with backend collections and then moves upstream to include pre-service and pre-statement engagement. This comprehensive approach ensures that patients are consistently engaged and educated, improving both satisfaction and payment rates across the continuum of care.

Closing Remarks

PayJourney is redefining the patient financial experience by offering the first end-to-end solution that improves patient engagement, maximizes affordability, and increases collection rates. By providing transparency, education, and affordable payment options, PayJourney empowers patients to make informed decisions and pay their bills on time, all while helping hospitals recover more revenue.

Healthcare systems that adopt PayJourney can expect to see increased cash collections, reduced bad debt, improved patient satisfaction, and greater financial clarity—all with less administrative effort and more efficient resource allocation. PayJourney is committed to providing a white-glove service to patient populations while maximizing collections, thereby revolutionizing the way healthcare organizations approach their patient payment journey.